Home Mortgage Tips Everybody Ought To Try Out

Content author-Pena CaseHome mortgages can be a bit overwhelming. You do not have to be overwhelmed, though, if you take the time to learn more about them. When it comes to your finances it is best to learn all you can before signing on the dotted line. Keep reading to learn about taking out a home mortgage.

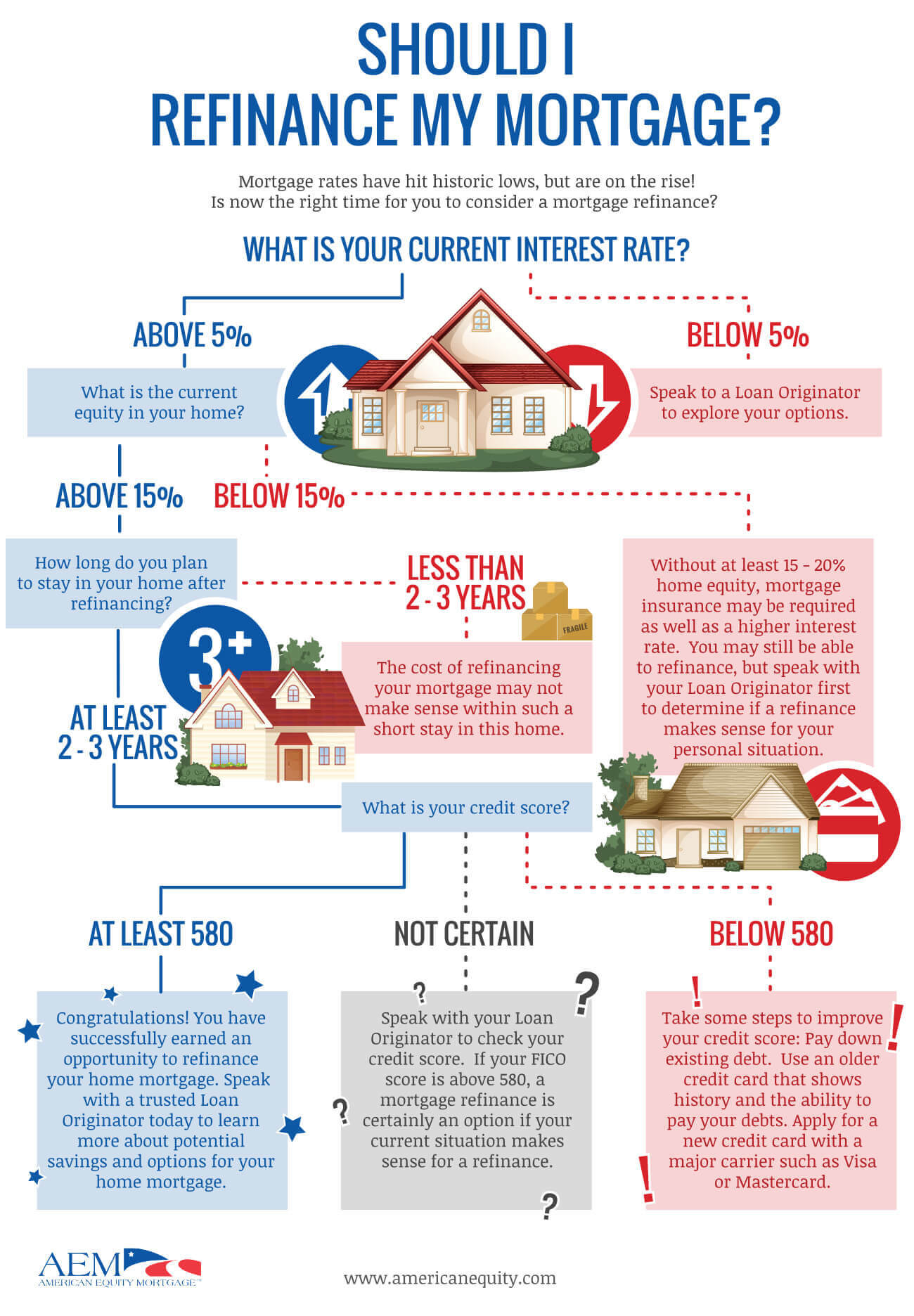

Understand your credit score and how that affects your chances for a mortgage loan. Most lenders require a certain credit level, and if you fall below, you are going to have a tougher time getting a mortgage loan with reasonable rates. A good idea is for you to try to improve your credit before you apply for mortgage loan.

Be prepared before obtaining your mortgage. Every lender will request certain documents when applying for a mortgage. Do not wait until they ask for it. Have the documents ready when you enter their office. You should have your last two pay stubs, bank statements, income-tax returns, and W-2s. Save all of these documents and any others that the lender needs in an electronic format, so that you are able to easily resend them if they get lost.

Remember that the interest rate isn't the most important part of a mortgage. You also have to think about closing costs, points and other incidentals. There are different kinds of loan as well. https://www.which.co.uk/consumer-rights/advice/how-do-i-get-money-back-that-i-ve-sent-to-the-wrong-account-azEmi4q7sePx is why you have to find out as much as you can about what you're eligible for.

Do not go on a spending spree to celebrate the closing. Many times, lenders will check your credit before closing on the loan. Wait to buy your new furniture or other items until after you have signed your mortgage contract.

Understand the difference between a mortgage broker and a mortgage lender. There is an important distinction that you need to be aware of so you can make the best choice for your situation. A mortgage broker is a middle man, who helps you shop for loans from several different lenders. A mortgage lender is the direct source for a loan.

Talk to people you know and trust about what they know about home loans. They might have some helpful advice for you. Their advice can help you avoid pitfalls that they experienced. The more contacts you connect with, the better information you will have.

Search for the most advantageous interest terms possible. The bank wants you to take the highest rate possible. Don't let yourself be a victim of this. Go to different banks to find the best deal.

Read the fine print of your mortgage contract before signing. Many times home buyers find out too late that their fixed rate loan has a balloon payment tied to the end of the loan contract. By reading over the contract you can ensure that you are protected throughout the entire loan term.

Current interest rates on home mortgages are lower than they have been in years. Experts expect them to begin increasing again shortly, so now is a great time to purchase a home and finance it at a low rate. The shorter the term of the mortgage, the better the rate you will be able to get.

Keep your job. Lenders look into many aspects of your financial situation and one very important aspect is your employment income. Stability is very important to lenders. Avoid moving jobs or relocating for as long as possible before you apply for a home mortgage. This will show them that you are stable.

Save up as much as you can before you look into buying a home. The more that you have to put down, the better that the terms of your home mortgage contract will be. Essentially, anything that you have to take out on loan could cost you three times that by the end, so save as much as is possible first.

Contrary to popular belief, there are plenty of lenders out there who will loan to you. So you need to shop around with your loan options. Never jump at the first opportunity you find. This will leave you paying far too much and will leave you obligated to a loan whose terms are not favorable to you.

Most financial institutions require that the property taxes and insurance payments be escrowed. This means the extra amount is added onto your monthly mortgage payment and the payments are made by the institution when they are due. This is convenient, but you also give up any interest you could have collected on the money during the year.

Let your social circle know that you are trying to get a mortgage. Friends, family and even coworkers can be wonderful sources of referrals and first hand testimony as to who to use or avoid. Get online and seek out reviews and feedback from previous customers to get a feel for who is right for you.

Before applying for https://www.ft.com/content/97b44628-450a-4535-8605-d5a7b8e5cbff , get your debts in order. Consolidate small debts with high interest rates and put a solid effort into paying them off. Do not take on new debt while you are preparing to apply for a home mortgage. The cleaner your debt record when you apply for a home mortgage, the better your chances of getting approval for a good loan at a good rate.

Don't be scared to wait for a better loan. During certain months of the year, a lot of terrific options will become available. You may also find a new lender who just opened, or the government may pass a new stimulus plan which could help you out. Remember that good things really do come to those who wait.

Remember that it takes time to get a mortgage closed; therefore, it is important to include enough time in the sales contract for the loan to close. Although it may be tempting to say the deal will be closed within 30 days, it is best to use a 60 or 90 day timeframe.

Realizing that you have just bought a home and have a good mortgage is a great feeling. This is a loan that you're going to carry for years, and you want it to be both affordable and accommodating. So, use the information that has been passed on to you so that you can find a good mortgage.